Image source, Getty Images

-

- Author, Ben Chu, Daniel Wainwright y Phil Leake

- Author's title, BBC Verify

From his return to the White House, Donald Trump has shaken the world trade system.

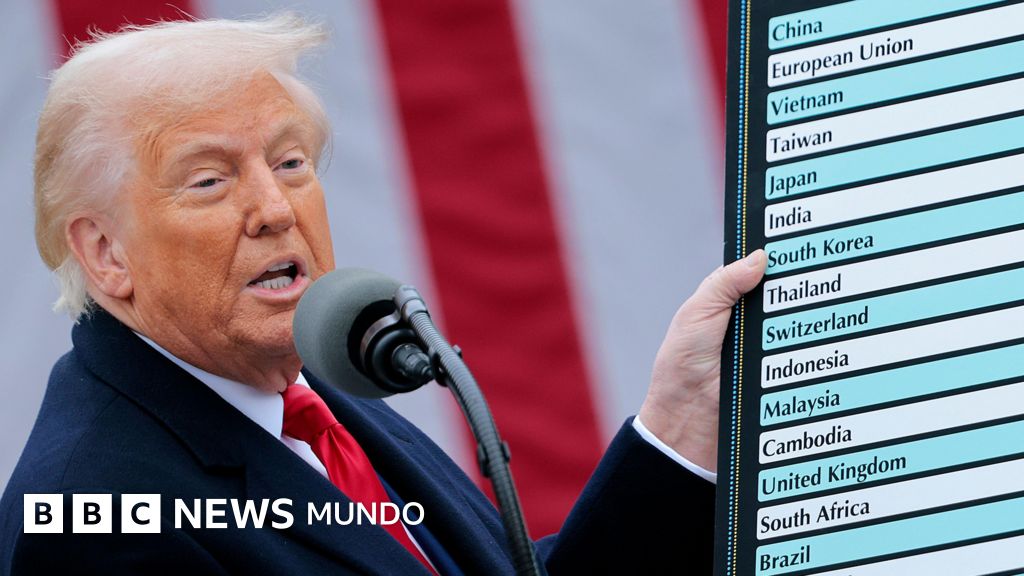

On April 2, which he called the day of liberation, the US president announced a series of “reciprocal” tariffs, or import taxes, for dozens of countries around the world.

Many of them have been temporarily suspended and since then Trump has also announced agreements with several partners – among them the United Kingdom, Vietnam, Japan and the European Union – to reduce some of the tariff percentages.

However, Washington has also imposed specific tariffs on certain products and goods, such as cars or steel, and the global average of the US tariff rates is the highest in almost a century.

Tariffs are ultimately paid by US companies that introduce goods in the country from abroad.

The impact of all this is being felt in the American and world economy in different ways.

More tariff income for the US

The Budget Lab (Center for Budget Studies) of the University of Yale calculates that, on July 28, 2025, the average effective tariff imposed by the US imposed on the imports of goods stood at 18.2%, the highest since 1934.

In 2024, before Donald Trump returned to the presidency, the figure was 2.4%.

This important increase has triggered the tariff income of the US government.

In June 2025, these amounted to US $ 28,000 million, the triple that in 2024, according to official United States data.

The Congress Budget Office (CBO), which is the US Fiscal Control Agency of the US Fiscal Control, estimated in June that the increase in tariff income, based on the new US tariffs imposed between January 6 and May 13, 2025, would reduce the accumulated borrowing of the US government in 10 years until 2035.

However, the CBO also considered that tariffs would undermine the growth of the US economy.

He also projected that the additional income generated by the tariffs will be neutralized by the profits that will be lost with the Trump administration tax cuts in the next decade.

Increase in US trade deficit

Donald Trump interprets bilateral commercial deficits as evidence that other countries take advantage of the United States by selling more products than they buy.

One of the justifications of its tariffs is to deal with that imbalance by braking imports and forcing other countries to reduce their own barriers to US products.

However, one of the consequences of Donald Trump's trade war, for the moment, has been the increase in imports of goods by the United States.

This is because US companies collection of supplies before the application of tariffs to avoid being forced to pay the additional tax.

Meanwhile, US exports have only shown a modest increase.

The net result is that the commercial deficit of United States goods has increased, not decreased.

In March 2025 it reached the record of US $ 162,000 million, before going to US $ 86,000 million in June.

The distortion caused by the accumulation of stocks will fade, but in the long term many economists expect the Trump administration to continue fighting to reduce the general commercial deficit of the United States.

This is because they attribute the deficit mainly to structural imbalances of the US economy – a national persistent expense superior to national production – rather than unfair commercial practices from other countries to the United States.

China exports less to the United States

Trump imposed punitive tariffs on China, with taxes that at one time reached 145%.

They have been reduced to 30%, but the impact of these commercial hostilities on Chinese trade with the United States has been significant.

The value of Chinese exports to the US in the first six months of 2025 decreased 11% compared to the same period of 2024.

Meanwhile, China's exports have grown to some of their other commercial partners, suggesting that Chinese companies have been able to find customers in other countries.

Chinese exports to India so far from 2025 have increased 14% compared to the same period last year, and with the EU and the United Kingdom have risen 7% and 8% respectively.

It also highlights the 13% increase in the value of Chinese exports to ASEAN nations – which include Vietnam, Thailand, Indonesia and Malaysia – during that period.

The Trump administration has been concerned about the possibility that Chinese companies try to avoid the tariffs imposed by the United States by establishing operations in neighboring countries of Southeast Asia – to those that export semi -polished products – and exporting from there the final products to the United States.

This “tariff jump” occurred when Donald Trump imposed taxes on Chinese solar panels in their first mandate and some economists argue that the increase in Chinese exports to the nations of ASEAN could be related to the same phenomenon.

More commercial agreements

Some countries have responded to Trump's commercial war trying to deepen commercial ties with other nations, instead of imposing their own barriers.

The United Kingdom and India have signed a commercial agreement that had been negotiating for three years.

Norway, Iceland, Switzerland and Liechtenstein, which are part of the European Free Trade Association (AELC), have signed a new commercial agreement with several Latin American countries of Mercosur.

The EU continues with a new commercial agreement with Indonesia.

Canada is studying a free trade agreement with ASEAN.

In addition, some countries have taken advantage of the fracture of trade between the United States and China.

China has traditionally been a large soybean importer from the United States, which uses as fodder for its 440 million pigs.

But in recent years Beijin has been decreasing more and more to buy its soy to Brazil instead of the United States, a trend that, according to analysts, has accelerated as a result of Donald Trump's last commercial war and the new retaliation tariffs of Beijing to US agricultural imports.

In June 2025 China imported 10.6 million tons of soybeans from Brazil and only 1.6 million tons from the United States.

When China put retaliation tariffs on American soy imports in Donald Trump's first mandate, his administration felt the need to directly compensate for US farmers with new subsidies.

The prices in the US begin to rise

Economists warn that Trump's tariffs will end up pressing up the prices in the US by making imports.

The official inflation rate of the United States in June was 2.7%, a figure slightly higher than 2.4% in May but below January 3%.

The accumulation of stock at the beginning of the year helped retailers to absorb the impact of tariffs without the need to raise sales prices to the public.

However, economists saw in the last official data some indications that Trump's tariffs are beginning to have an impact on US consumption prices.

Some imported goods, such as large appliances, computers, sports equipment, books and toys, registered a remarkable price increase in June.

Pricing Lab researchers (Center for Price Studies) at Harvard University, who are examining the effects of 2025 tariff measures in real time using online data of four great American retail retailers, have discovered that the prices of imported products in the US and national products affected by tariffs have increased faster than that of national products not affected by tariffs.

This article was written and edited by our journalists with the help of an artificial intelligence tool for translation, As part of a pilot program.

Subscribe here To our new newsletter to receive every Friday a selection of our best content of the week.

And remember that you can receive notifications in our app. Download the latest version and act.